Jewelry and Perverse Incentives

With a perverse incentive, a company incents its employees to behave in ways that are contrary to the company’s interests. The company, in other words, pays employees to do things that reward the employee but prevent the company from reaching its stated goals. (See here and here for more detail).

Why would a company do that? Sometimes the stated goals of the company are not its actual goals. For instance, the company may say that it aims to increase customer satisfaction. That’s nice window dressing but the real goal may be to “make the numbers”. So, the company may incent its sale force to act in ways that make the numbers even if such behavior also reduces customer satisfaction. In this example, studying the perverse incentive can help us understand what the company’s real goals are. This seemed to be the case at Wells Fargo, for instance.

In other cases, one business process conflicts with another. Perhaps each process is perfectly fine when running in isolation. When they run in tandem, however, they create perverse incentives. A good example comes from Signet Jewelers, the owner of several retail jewelry chains, including Jared’s, Kay Jewelers, and Zales. (I discovered this case in the business pages of the New York Times. Click here for the original article.)

The Signet situation involves two different business processes: sales and financial credit. By combining the two, Signet created a perverse incentive. Each business process works fine in and of itself. It’s the combination that spawns confusion. Here are the two processes:

- You’re a banker who makes loans to individuals and companies. Your goal is to make profitable loans that are repaid in a timely manner. Your compensation is based on this. If you make a lot of good loans, your compensation goes up. If you make risky loans that aren’t paid back, your compensation goes down. Your incentives line up nicely with the bank’s goals.

- You’re a manager at a retail jewelry chain. You aim to sell more jewelry than you did last month or quarter or year. If you do, your compensation goes up. If you don’t, it goes down. Again, your incentives line up nicely with your company’s goals: to sell more jewelry.

Now let’s change the scenario. You’re now the manager of a retail jewelry store that also offers loans to its customers to enable them to buy more jewelry. Your compensation is based on how much jewelry you sell.

It sounds like a good idea. So, what’s wrong with this picture? To sell more jewelry, you have a strong incentive to give loans to non-credit-worthy individuals. You make the sale, but a relatively high proportion of the loans you make go bad and are not repaid. The company either writes off the loans or spends a lot of money with debt collectors trying to redeem them. The net result is often a negative: you sell more but also lose more.

The Signet example is just one of many. Once you’re familiar with the concept of perverse incentives, you can find them most everywhere, including the morning paper.

Failure Is An Option

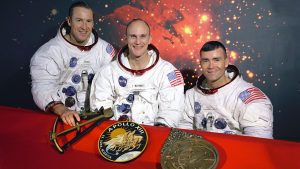

The movie Apollo 13 came out in 1995 and popularized the phrase “Failure is not an option”. The flight director, Gene Kranz (played by Ed Harris), repeated the phrase to motivate engineers to find a solution immediately. It worked.

I bet that Kranz’s signature phrase caused more failures in American organizations than any other single sentence in business history. I know it caused myriad failures – and a culture of fear – in my company.

Our CEO loved to spout phrases like “Failure is not an option” and “We will not accept failure here.” It made him feel good. He seemed to believe that repeating the mantra could banish failure forever. It became a magical incantation.

Of course, we continued to have failures in our company. We built complicated software and we occasionally ran off the rails. What did we do when a failure occurred? We buried it. Better a burial than a “public hanging”.

The CEO’s mantra created a perverse incentive. He wanted to eliminate failures. We wanted to keep our jobs. To keep our jobs, we had to bury our failures. Because we buried them, we never fixed the processes that led to the failures in the first place. Our executives could easily conclude that our processes were just fine. After all, we didn’t have any failures, did we?

As we’ve learned elsewhere, design thinking is all about improving something and then improving it again and then again and again. How can we design a corporate culture that continuously improves?

One answer is the concept of the just culture. A just culture acknowledges that failures occur. Many failures result from systemic or process problems rather than from individual negligence. It’s not the person; it’s the system. A just culture aims to improve the system to 1) prevent failure wherever possible or; 2) to ameliorate failures when they do occur. In a sense, it’s a culture designed to improve itself.

According to Barbara Brunt, “A just culture recognizes that individual practitioners should not be held accountable for system failings over which they have no control.” Rather than hiding system failures, a just culture encourages employees to report them. Designers can then improve the systems and processes. As the system improves, the culture also improves. Employees realize that reporting failures leads to good outcomes, not bad ones. It’s a virtuous circle.

The concept of a just culture is not unlike appreciative inquiry. Managers recognize that most processes work pretty well. They appreciate the successes. Failure is an exception – it’s a cause for action and design thinking as opposed to retribution. We continue to appreciate the employee as we redesign the process.

The just culture concept has established a firm beachhead among hospitals in the United States. That makes sense because hospital mistakes can be especially tragic. But I wonder if the concept shouldn’t spread to a much wider swath of companies and agencies. I can certainly think of a number of software companies that could improve their quality by improving their culture. Ultimately, I suspect that every organization could benefit by adapting a simple principle of just culture: if you want to improve your outcomes, recruit your employees to help you.

I’ve learned a bit about just culture because one of my former colleagues, Kim Ross, recently joined Outcome Engenuity, the leading consulting agency in the field of just culture. You can read more about them here. You can learn more about hospital use of just culture by clicking here, here, and here.

Relegate the State – A Modest Proposal – 1

You’ve been relegated.

I’ve always admired the European system of relegating athletic teams to lower divisions when they don’t perform well. The system creates much better competition while rewarding teams that do well and penalizing teams that fail.

Let’s say you own a soccer team in the “A” league, the highest level of competition. In addition to the “A” league, your country also has a “B” league, a “C” league, etc. Being in the “A” league provides a lot of privileges – greater attendance, television revenue, prestige, and so on. You have a lot of incentive to keep your club in the “A” league.

At the end of each season, however, the bottom three teams in the “A” league are relegated to the “B” league. At the same time, the top three teams in the “B” league are promoted to the “A” league. (The number of teams moving up or down varies from league to league). You have a very strong incentive not to let your team fall to the bottom of the standings.

In the American system, on the other hand, an “A” league team will always stay in the “A” league, no matter how poorly it performs. There’s no chance that my Colorado Rockies will be relegated to the minor leagues even though they stunk up the major leagues last year.

The American system creates a number of perverse incentives. There’s a clear incentive to lose games one year to improve your draft position the next year. Even if you have a crummy team, you still get to share in league-related income, like TV revenues. You don’t get the glory of winning a championship, but the financial penalties of failing are not very stiff. If you’re just in it for the money, there’s no real incentive to win.

The European system seems clearly superior. It creates greater competition, removes perverse incentives, and creates a system of accountability. You win, you’re in. You lose, you’re out. That seems much more American than European.

I’ve been wondering lately if we couldn’t apply a relegation system to the states of the United States. We have 50 states and some are clearly more successful than others. Even the failing states, however, reap huge rewards from remaining in the union.

In our current system, there’s no real incentive for a state to succeed. Even if a state fails, it still gets huge subsidies from other states. In fact, the greater the failure, the greater the subsidy. It’s a perverse incentive: the worse you do, the more you get.

In fact, some states – let’s call them moocher states – get a net benefit of billions of dollars from the federal government. These states pay a relatively small amount in federal taxes but get huge federal subsidies in return. There’s no incentive for such a state to invest locally. It would only reduce the federal subsidy.

The giver states, on the other hand, are penalized for their success. They see their moneys drained away to subsidize the moocher states. This reduces their incentive to continue to succeed.

So, what to do with the moocher states? Let’s set up a league table and rank states on their success. Every ten years, let’s drop the bottom five from the union. That will improve competitiveness, enhance local autonomy, emphasize responsibility and accountability, and erase perverse incentives. What could be more American than that?

Perverse Incentives

But is it for the right thing?

Let’s say I’m a successful sales rep at a business-to-business software company that’s trying to improve customer satisfaction. The company wants me to take good care of my customers, tell the truth, and make them feel loved.

At the same time, the company pays me based on how much software I sell each quarter. It’s in my best interest to sell as much as I can even if I have to stretch the truth a bit and promise more than I can deliver. Of course, stretching the truth and failing to deliver often result in lower customer satisfaction. So the company is incenting me to behave in ways that defeat its own objectives.

In Britain, this is known as the principal-agent problem. In this case, the principal is the company. I’m an agent acting on the company’s behalf. The problem is that the agent’s incentive (my commission) is different than the principal’s objective. We’re working at cross-purposes.

Paul Nutt and other American writers generally refer to this situation as a perverse incentive. According to Wikipedia, a perverse incentive”… has an unintended and undesirable result which is contrary to the interests of the incentive makers.”

Examples abound. We may strive for smaller government but we typically pay government managers based on how many employees they have, not on the profits they generate (since they generate no profits). We encourage orphanages to place children with families, but we pay subsidies based on how many children are in the orphanage.

The examples may sound bizarre but perverse incentives are all too easy to create. Nutt gives a particularly perverse example: the company that proclaims, “We will not accept failure.” While that may sound bold and brave, it sets up a perverse incentive.

Every company fails from time to time. When a failure occurs, it’s in the company’s best interest to analyze it, understand it, and use it as a teachable moment. But companies that don’t accept failure will never get a chance to do this. Employees associated with the failure will bury it as deeply as they can. Otherwise, they’ll get fired.

What should you do when you inevitably encounter a perverse incentive? The first thing is to make sure it’s known. Many times executives set lofty goals (“we will never fail”) without realizing just how perverse they are. Calling attention to perversity is a useful first step.

Second, it’s time to discuss alignment. We often think of alignment in terms of focusing on the same goal. That’s good but only if the incentives for achieving that goal are also aligned. A comprehensive and detailed review of incentives will help identify areas of misalignment. This is when a good HR department is worth its weight in gold.