Finally! A Way To Measure Corporate Culture.

I tell my management students that executives should focus on one task above all others: developing a positive, supportive corporate culture. When a company has a positive culture, all things are possible. When a company has a negative culture, very few positive outcomes occur.

The problem, of course, is how to assess a culture. How does one know if a culture is positive or negative? It’s perhaps the most important question an executive (or job applicant) can ask. But the answer is murky at best. Further, how can one tell if a culture is getting better or worse? Is the company living up to its professed values? How does one know?

A new company called CultureX may help us solve the problem. Formed in conjunction with MIT’s Sloan School of Management, CultureX uses the millions of employee reviews on Glassdoor to analyze corporate cultures. Along the way, CultureX identifies the most frequent values companies profess, the norms used to promote those values, and how employees view company performance in fulfilling the values.

CultureX uses a range of textual analysis tools to analyze free-form employee comments in Glassdoor reviews. The result is a composite view of what it’s like to work in an organization – from employees’ perspective. As you might expect, employee reviews often highlight what the company actually values as opposed to what it professes to value.

CultureX initially applied its methodology to analyze 1.2 million Glassdoor reviews for some 500 companies. The average Culture 500 company has over 2,000 employee reviews. The analysis identified some 60 “… distinct values that companies listed in their corporate values statements.” From the 60, CultureX researchers winnowed the list down to the Big Nine that were cited most frequently. These are: agility, collaboration, customer, diversity, execution, innovation, integrity, performance, and respect.

CultureX researchers then built an interactive tool which “… provides users a snapshot of how frequently and positively employees … speak about each of the Big Nine values.” Users can see how employees discuss each of the Big Nine – even those that a company doesn’t include in its own values statements.

CultureX uses Amazon as an example of how the tool might be used. Amazon’s employee reviews, for instance, spoke frequently and positively about two specific values: innovation and customer centricity. (Innovation was about two standard deviations above the mean; customer centricity was about one standard deviation above). On the other hand, employees were “much less enthusiastic” about the company’s respect for employees – about 1.5 standard deviations below the mean.

How might one use these data? An Amazon executive might be concerned that employees don’t feel respected. The executive might develop programs to improve the company’s performance. (I’m sure that consultants from CultureX would have some suggestions). The executive could then use changes over time in the “respect” value to monitor progress (or lack of it). Similarly, an executive might compare her own company to any number of other companies – in the same industry or in others – to identify competitive gaps and/or advantages.

But the data are not reserved solely for executives. Want to work for a company that is truly innovative? The CultureX data can help you identify which companies are walking the walk and not just talking the talk. Potential employees can identify companies that match their value set. Companies can identify potential employees whose values match the company’s. With better information, both sides stand to benefit.

CultureX’s work should help us focus more attention on the role of corporate culture in business success. The data set could become a useful platform for investors, executives, employees, and job applicants. So … how’s your company doing?

Big Daddy/Big Data

Are older people wiser? If so, why?

Some societies believe strongly that older people are wiser than younger people. Before a family or community makes a big decision in such societies, they would be sure to consult their elders. The elders’ advice might not be the final word but it’s highly influential. Further, elders always have say in important matters. Nobody would think of not including them.

Why would elders be wiser than others? One theory suggests that older people have simply forgotten more than younger people. They tend to forget the cripcrap details and remember the big picture. They don’t sweat the small stuff. They can see the North Star, focus on it, and guide us toward it without being distracted. (Click here for more).

For similar reasons, you can often give better advice to friends than you can give to yourself. When you consider your friend’s challenges and issues, you see the forest. When you consider your own challenges and issues, you not only see the trees, you actually get tangled up in the underbrush. For both sets of advisors – elders and friends – seeing the bigger picture leads to better advice. The way you solve a problem depends on the way you frame it.

According to this theory, it’s the loss of data that makes older people wiser. Is that all there is to it? Not according to Seth Stephens-Davidowitz, the widely acclaimed master of big data and aggregated Google searches. Stephens-Davidowitz has written extensively on the value of big data in illuminating how we behave and what we believe. He notes that companies and government agencies are increasingly trawling big data sets to spot patterns and predict – and perhaps nudge – human behaviors.

What does big data have to do with the wisdom of the aged? Well … as Stephens-Davidowitz points, what’s an older person but a walking, talking big data set? Our senior citizens have more experiences, data, information, stories, anecdotes, old wives’ tales, quotes, and fables than anybody else. And – perhaps because they’ve forgotten the cripcrap detail – they can actually retrieve the important stuff. They provide a deep and useful data repository with a friendly, intuitive interface.

As many of my readers know, my wife and I recently became grandparents. One of the pleasures of grandparenting is choosing the name you’d like to be known by. I had thought of asking our grandson to call me Big Daddy. But I think I’ve just come up with a better name. I think I’ll ask him to call me Big Data.

Seth Stephens-Davidowitz is probably best know for writing the book, Everybody Lies: Big Data, New Data, and What The Internet Can Tell Us About Who We Really Are. He’s also a regular contributor to the Op-Ed pages of the New York Times. I heard his idea about seniors-as-big-data on an episode of the podcast Hidden Brain. (Click here). I mentioned his work a few years ago in an article on baseball and brand loyalty. (Click here). He’s well worth a read.

Baseball, Big Data, and Brand Loyalty

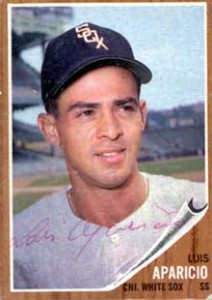

My hero.

I started smoking in high school but didn’t settle on “my” brand until I got to college. My Dad smoked Camels for most of his life but I decided that was not the brand for me. (Cough, hack!) Ultimately, I settled on Marlboros.

How I made that decision is still a mystery to me. In its very earliest days, Marlboro was positioned as a “woman’s brand” with slogans like “Ivory tips protect the lips” and “Mild as May”. That didn’t work very well, so the brand changed its positioning to highlight rugged cowboys in the American west. The brand took off and along the way I got hooked.

Though I don’t know why I chose Marlboros, I do know that it was a firm decision. I smoked for roughly 20 years and I always chose Marlboro. This is why brand owners focus so much attention on the 18-to-24 year-old segment. Brand preferences established in those formative years tend to last a lifetime.

But brand preferences often form quite a bit earlier. Brand owners may actually be late to the party. For example, I chose my baseball team preferences when I was much younger.

I played Little League baseball and was crazy about the sport. In our league, the teams were named after big league teams. Even though we lived in Baltimore, I played shortstop and second base for the Chicago White Sox. (The book on me: good glove/no bat).

At the time, Luis Aparicio and Nellie Fox played shortstop and second base for the real Chicago White Sox. They were my heroes. I knew everything about them, including the fact that they both weighed about 150 pounds in the pre-steroid era. I formed an emotional connection with the White Sox at the age of 10 or 11 and I still follow them.

My brand loyalty even rubbed off on the “other” team in Chicago, the Cubbies. Their shortstop was the incomparable Ernie Banks. I had heard of the Holy Trinity and I assumed that it was composed of Luis, Nellie, and Ernie.

I thought about all this when I opened the New York Times this morning and read about the nexus of Big Data, Big League Baseball, and Brand Development. Seth Stephens-Davidowitz has used big data to probe fan loyalty to various major league teams. (Unfortunately, he omits the White Sox).

Among other things, Stephens-Davidowitz looks at fans’ birth years and finds some interesting anomalies. For instance, an unusually large number of New York Mets fans were born in 1961 and 1978. Why would that be? Probably because boys born in those years were eight years old when the Mets won their two World Series championships. Impressionable eight-year-old boys formed emotional attachments that last a lifetime.

How much is World Series championship worth? Most brand valuations focus on how a championship affects seat, television, and auxiliary revenues. Stephens-Davidowitz argues that this approach fundamentally undervalues the brand because it omits the value of lifetime brand loyalty. When he recalculates the value with brand loyalty factored in, he concludes that “A championship season … is at least twice as valuable as we previously thought.”

What’s a brand worth? As I’ve noted elsewhere, it’s hard to measure precisely. But we form emotional attachments at very early ages and they last a very long time. As Stephens-Davidowitz concludes, “…data analysis makes it clear that fandom is highly influenced by events in our childhood. If something captures us in our formative years, it often has us hooked for life.”

Is Big Data The Death Of Strategy?

More efficient. Not more competitive.

Why is milk always at the back of the grocery store? Because of the precursor of Big Data. Let’s call it Little Data.

Retailers have always studied their customers’ behavior. An astute observer is just as valuable as mountains of data. In the era of Little Data, grocers noticed that shoppers usually waited until they needed several items before going to the store. Milk was different, however. If a household were out of milk, a family member would go to the store for the express purpose of buying milk – and only milk.

Once grocers noticed this, they moved the milk to the back of the store. Shoppers who came in only for milk might notice several other things they needed (or wanted) on the trip through the store. Rather than buying one item, they might buy half a dozen. By relocating the milk, the grocer could sell more.

What happened next is instructive. Once one grocer figured out the pattern and moved the milk to the back, all other grocers followed suit. I’ve verified this in at least a dozen countries. The milk is always at the back. No grocer can establish a competitive advantage by putting the milk at the back of the store.

What does this have to do with strategy? I’ve always subscribed to Michael Porter’s insights on the difference between operational effectiveness and strategy. In his classic article, What Is Strategy?, Porter defines operational effectiveness as doing the same things as competitors but doing them better. Strategy, on the other hand, means, “… preserving what is distinctive about a company. It means performing different activities from rivals or performing similar activities in different ways.”

In the era of Little Data, we could figure out simple things like how consumers buy milk. Now, in the era of Big Data, we can identify much more subtle patterns in much greater detail. However, the underlying dynamic doesn’t change. Once one company figures out a new pattern, every one of its competitors can also implement it. As Porter points out, “…the problem with operational effectiveness is that best practices are easily emulated. … competition produces absolute improvement in operational effectiveness, but relative improvement for no one.”

Big Data, then, is about operational effectiveness, not strategy. Yet when I read about Big Data in management journals, I sense that it’s being treated as strategic weapon. It’s not. Companies may have to invest in Big Data to keep up with the Joneses but it’s never going to be a fundamental differentiator or a strategic advantage. It’s time for Big Companies to wise up about Big Data.